Impact Investing "Supply" Failing to Meet Demand

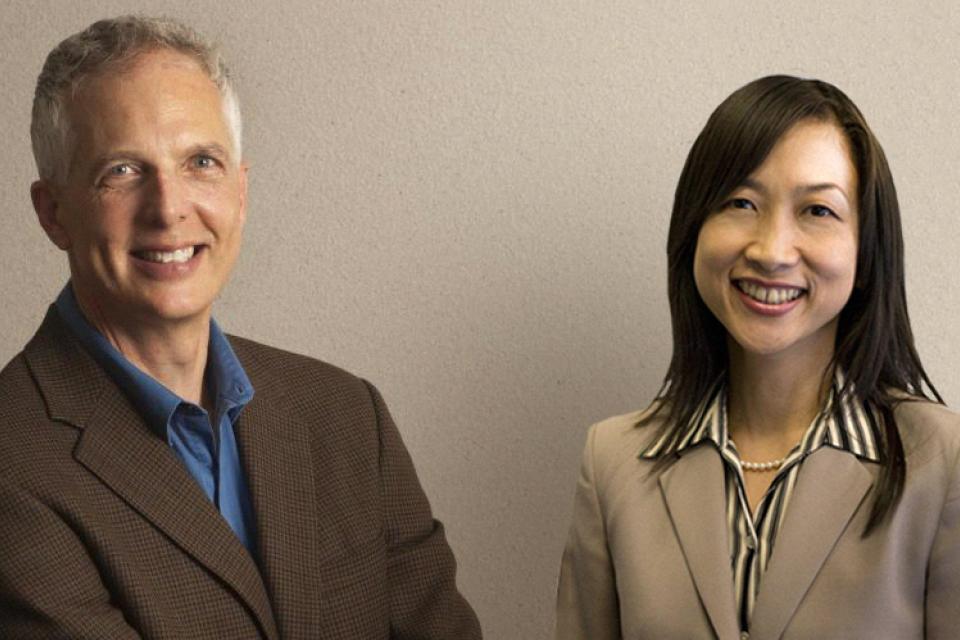

Moskowitz Prize Winners: Professor Brad Barber and Associate Professor Ayako Yasuda Study Shows Europe’s Demand for Impact Funds Over Traditional Investments Three Times Higher Than in North America

The demand for impact investing alternatives is outstripping the available supply of such choices for investors, according to a new study co-authored by Professor Brad Barber and Associate Professor Ayako Yasuda that was awarded UC Berkeley’s 2016 Moskowitz Prize for Socially Responsible Investing during a special ceremony Nov. 10 at the 27th annual SRI Conference in Denver.

The study found the pinch is most acute in Europe where the demand for impact investing (versus traditional investments) is three times higher than in the U.S. and the rest of North America.

“Impact Investing” is a study of 3,500 limited partners, 5,000 funds, and 25,000 capital commitments results and was conducted by Barber, Yasuda and Associate Professor Adair Morse of the Haas School of Business at the University of California at Berkeley.

“(W)e find a 13.5 percent higher investment rate for impact funds compared to the benchmark investment rate of traditional venture funds. Our results imply that the supply of impact funds is incomplete, failing to meet demand,” the study concludes.

Barber, Yasuda and Morse developed an “investment choice model” to chart investor demand for impact funds over traditional options, matching characteristics between fund and investor, referred to as limited partner or LP in the framework. Another important finding shows that demand for impact is higher in countries that are United Nations Principles for Responsible Investment (UNPRI) signatories.

"This project has taken several years to cultivate from the germ of an idea to a working paper and has been a labor of love,” said Barber. “We are very interested in understanding the mechanisms that help to ensure capital is deployed in a way that redounds to the benefit of society. The Moskowitz prize is a wonderful and welcome endorsement of our efforts and research agenda. We're very grateful for this acknowledgement."

The Moskowitz Prize is determined and managed annually by the Center for Responsible Business at UC Berkeley's Haas School of Business. The prize is the only global award recognizing outstanding quantitative research in the field of sustainable, responsible, impact investing. This year marks the 21st year of this academic prize. The prize was named for Milton Moskowitz, one of the first investigators to publish comparisons of the financial performance of portfolios screened for social and environmental issues and impacts.

Since its inception in 1996, the Moskowitz Prize has been awarded annually at The SRI Conference, the longest running conference serving investors and investment professionals in the sustainable, responsible, impact (SRI) investment industry in North America. The SRI Conference is produced by First Affirmative Financial Network.

Steve Schueth, producer of The SRI Conference and president of First Affirmative Financial Network said: “Even though investing for impact in the United States has fallen behind the demand in Europe, there is no mistaking the growth trend here and around the world. Sustainable investing, responsible investing, impact investing is an investor-driven phenomenon; it is not an investment concept that was invented by Wall Street and then ‘sold’ to investors. Investing for positive impact is here… and it is here to stay.”

Lisa R. Goldberg, co-director of the Consortium for Data Analytics in Risk and adjunct professor of economics and statistics at UC Berkeley said: “The main empirical finding is that demand for impact funds greatly exceeds supply. This represents a huge incentive for innovation in impact investing funds that can do such things as mitigate climate change and elevate the standard of living around the world.”

Robert Strand, executive director, Berkeley-Haas Center for Responsible Business said: “This represents what is likely to become a landmark article in the budding research field exploring impact investing. The sheer quantity and quality of measurement represented by this study is impressive.”

The 2016 Moskowitz Prize sponsors are Calvert Group, First Affirmative Financial Network, Nelson Capital Management, Rockefeller and Co., Neuberger Berman, and Trillium Asset Management.